Release Notes - May '20

We are happy to present the FinDock May '20 Release.

Important Dates:

- Release to Sandboxes: April 26, 2020

- Release webinar: April 30, 2020

- Release to Production: May 10, 2020

In this release, we have some big new features, as well as important enhancements and bug fixes.

- New features:

- Tikkie for FinDock

- New ProcessingHub connection flow

- Apple Pay and Google Pay with Stripe for FinDock

- iDEAL online payments with Stripe for FinDock

- Managed rules for Guided Matching

- New rule types and enhancements for Guided Matching

- Enhancements and bug fixes:

- Friendly API error on empty and invalid CampaignId

- CODA validation failure

- Increased performance Buckaroo redirect page

- Enrichment of Installment with default values on creation

- Stripe: reworked setup and added language parameter

- Added setting to determine handling of underpaid Installments

- NPSP Opportunity bank statement description mapping overridden on edit

Tikkie for FinDock

In an exclusive partnership with ABN AMRO’s Tikkie, FinDock brings Tikkie to Salesforce customers. With the Tikkie for FinDock extension, you get all the benefits of the popular Tikkie online payment method directly from within Salesforce. For more information, check out Tikkie for FinDock in our Knowledge Base.

Create Tikkie Payment Requests

FinDock now supports creating Tikkie payment requests from Salesforce. There are several options:

- Run a Payment Schedule with Payment Method ‘Tikkie’ to create Installments from Recurring Donations with a Tikkie URL and QR.

- Call the FinDock Payment API with Payment Method =

TikkiePayment Processor =FinDock-Tikkieto create an Installment with a Tikkie URL and a QR. - Execute a Payment Request Generator Run on a Campaign to create a Tikkie URLs and QRs on Campaign members without creating Installments. This saves storage and avoids manual actions to update unpaid Installments.

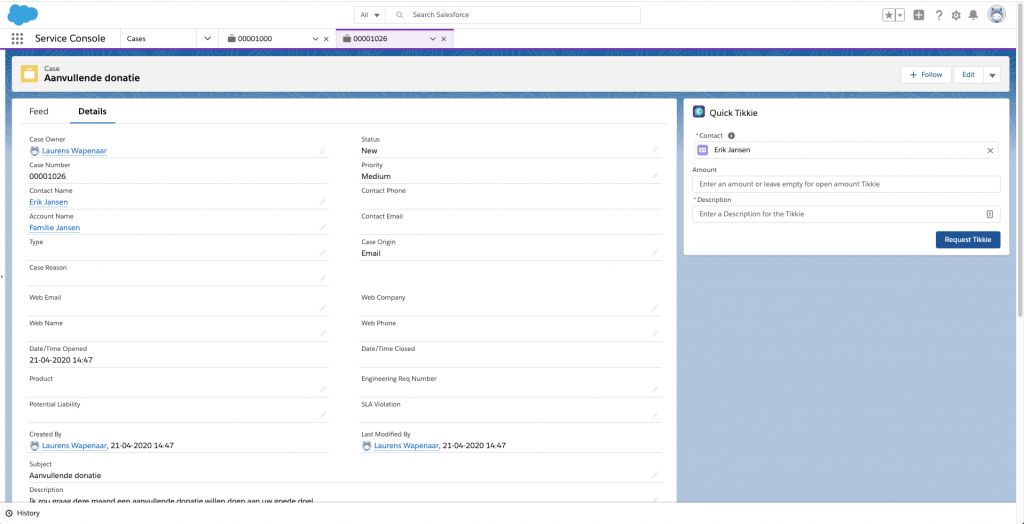

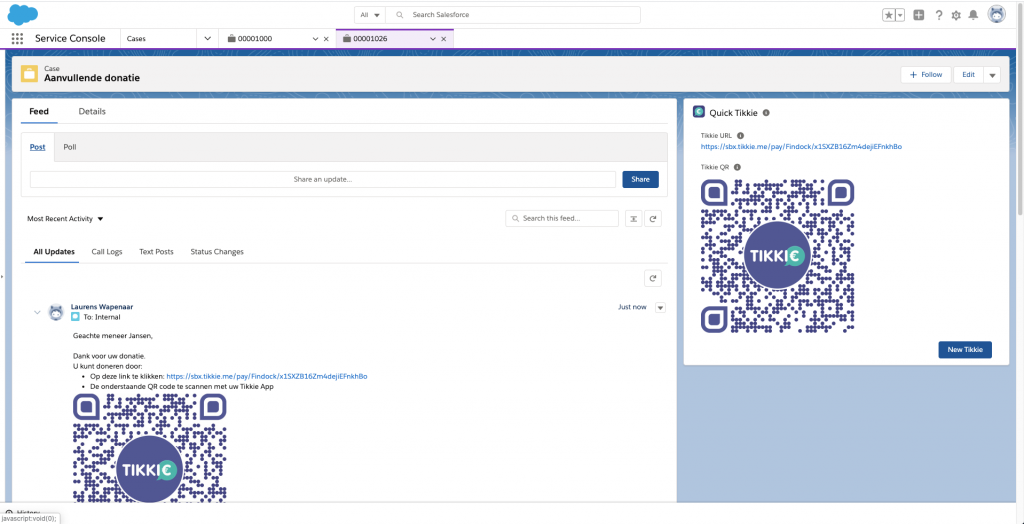

- Use the Quick Tikkie component on any object like Opportunity or Case to quickly generate a Tikkie URL and QR to use in Salesforce communication channels like Salesforce email & Chatter Posts and communication channels outside of Salesforce.

Tikkie for FinDock is multi-merchant enabled, so can be used with more than one Tikkie (ABN AMRO) account.

Quick Tikkie

You can use FinDock Quick Tikkie to create a Tikkie URL and QR on any object in Salesforce. Simply enter an amount (or leave the amount empty for an open Tikkie), add a description and click Request Tikkie. FinDock automatically:

- Generates a unique Tikkie URL and QR

- Attaches the QR image file to the record

- Creates an installment for the generated Tikkie

The Tikkie URL and QR can be shared in communication channels both inside and outside Salesforce. Quick Tikkie is implemented as a Salesforce component, so adding Quick Tikkie to any Salesforce object is quick and easy through Salesforce page layout settings.

Reconciliation of Tikkies with Guided Matching

FinDock can automatically reconcile payments through Tikkies against Payment Requests in Salesforce. To do this, FinDock captures notifications from Tikkie and creates Inbound Reports. On these Inbound reports you can run Guided Matching. To get you started, FinDock ships a set of Guided Matching Rules as Managed Rule Set for Tikkie. These rules finds and updates existing records, or creates new records based on the by Tikkie provided data.

New ProcessingHub connection flow

We have completely reworked how connections between ProcessingHub and Salesforce are managed. This enables a much simpler setup process, drastically reducing the time it takes to configure FinDock.

- ProcessingHub accounts and related management actions are now fully automated.

- All connections can be added and deleted from a single Salesforce page.

- Simply define an Integration User with the required permission sets and you are ready!

The connection process is simply:

- Select the Integration User for the connection.

- Press Connect.

- Log in to Salesforce with that user (if not already logged in).

- Allow access to FinDock.

Apple Pay and Google Pay with Stripe for FinDock

With the Stripe for FinDock extension, you can now accept payments with an Apple Pay or Google Pay wallet. If you use the Payment Method ‘Creditcard’ with Stripe, the payer has the possibility to choose to pay with their Apple Pay or Google Pay wallet in the payment details screen. This works on both mobile phones and Safari & Chrome desktop browsers if the payer has an Apple or Google wallet account enabled.

The payer may be prompted to add additional details to their wallet, like email address and billing address, if these are not already known.

FinDock stores payments made with Apple Pay or Google Pay wallets as regular payments linked to an installment. A Payment Profile with type ‘Creditcard’ is attached containing the wallet details received from Stripe. FinDock also stores whether a debit or credit card was used through the wallet in the ‘Funding Type’ field.

No additional configuration is needed to use Apple Pay or Google Pay with the Stripe for FinDock extension.

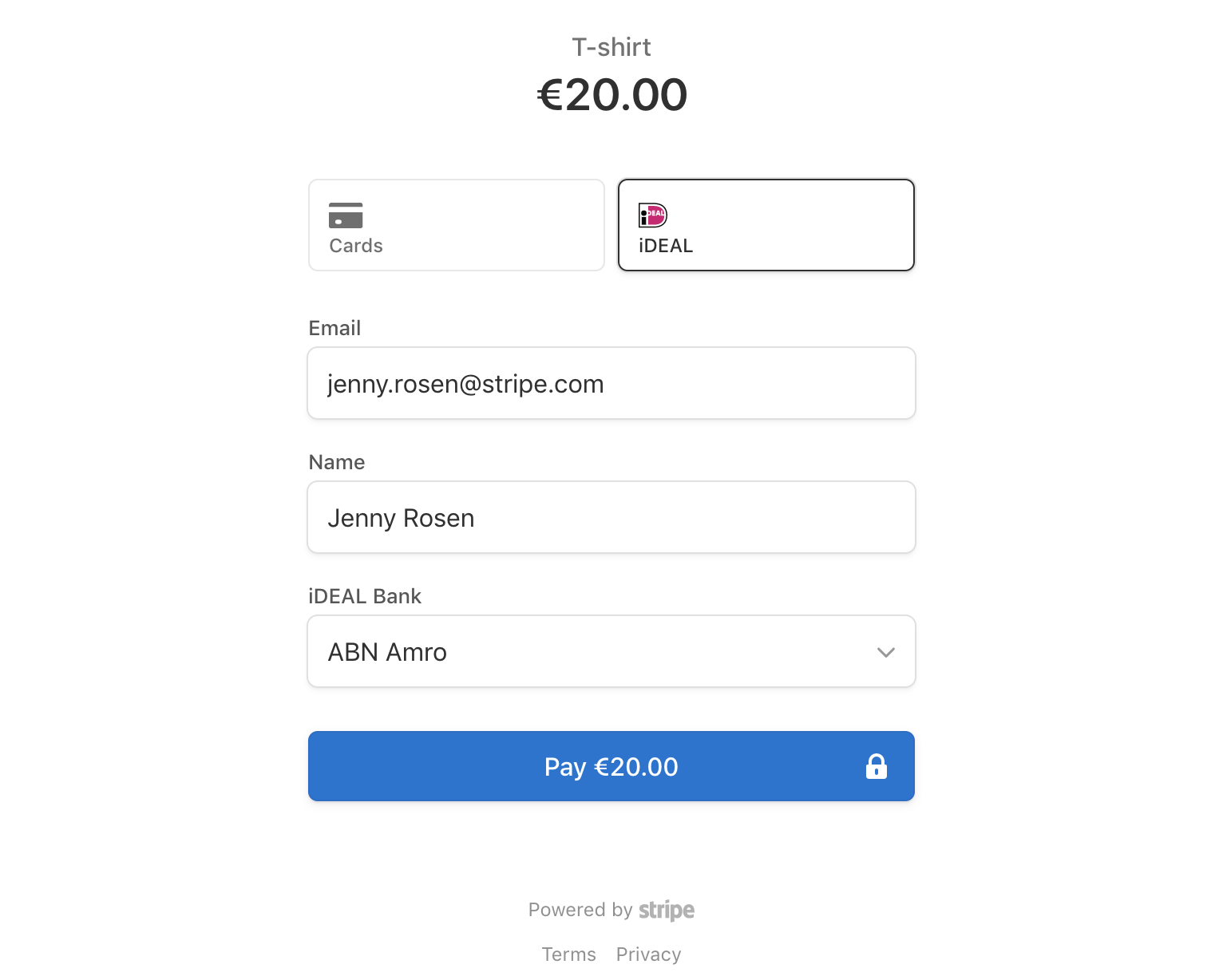

iDEAL online payments with Stripe for FinDock

It is now possible use iDEAL payments with Stripe. iDEAL is a payment method

for making online payments directly with a bank account. Payers can select their own bank, sign in to their online banking account, and confirm the payment.

If you already have installed Stripe for FinDock, you can simply activate the new iDEAL payment method in the Activation / Deactivation tab of the extension. For more information on enabling payment methods, please visit our Knowledge Base.

Stripe only provides the last 4 digits of the IBAN account used to perform the payment, so FinDock store the IBAN as XXXX-XXXX-XXXX-1234 in the Payment Profile.

Managed rules for Guided Matching

To help customers take Guided Matching into use, we have created managed rules that are defined and delivered by FinDock. The managed rules enable processing payment report data for reconciliation through Guided Matching right out of the box. In this release, we have included managed rules for:

- Bollettino Postale (Italian pay slip reports, downloaded from Poste.it)

- Tikkie (only payment data from Tikkie received via webhook)

Manged rules cannot be edited, deleted or reordered, but you can add your own custom rules before or after the rule set from FinDock. In addition to introducing managed rules, FinDock provides predefined suggested rules. These rules we believe are beneficial and improve the matching process. Suggested rules, unlike managed rules, you can modify. To find out more about Guided Matching managed rules, please see the new Guided Matching article.

New rule types and enhancements for Guided Matching

As we are continuously improving Guided Matching, we have added a new rule type and made several small enhancements:

- New Manage Source rule type: If you are using NPSP as a source package and Guided Matching does not find an existing Installment and Opportunity, FinDock creates an Opportunity based on the new Installment during the matching process. Errors on this process are now also be visible in the Rule Execution section of the Inbound Report record.

- Added Single Query Result Strategy option to Query rule type: where previously it was possible to decide what to do when multiple results were found with the query rule type, it is now possible to do the same when only a single result has been found. You can choose from two strategies:

- Take the result that was found and continue.

- Offer the result up for Guided Review if you are unsure of the results of your query.

- Added Show “Other” row option to Guided Review result strategies on Query rule type: this option allows the user to enter a value that was not pre-selected by the query.

- Added Starts with operator to Entry criteria on Query rule type.

Enhancements and bug fixes

Friendly API error on empty and invalid CampaignId

Issue: If an empty or invalid CampaignId was passed in the API, FinDock used a generic error message:

- error_message: Unexpected error occurred, Please contact support for help!

- error_code: 999

Solution : If the CampaignId is passed as an empty string, the CampaignId is not set. If an invalid CampaignId is passed (validated against Salesforce Id validation), the FinDock error message is:

- error_message: Bad CampaignId abc

- error_code: 020

CODA validation failure

Issue: FinDock incorrectly invalidated CODA files with empty lines for

Data record 2.3.

Solution: FinDock now validates these lines as expected according CODA validation rules and no longer invalidates the file.

Increased performance Buckaroo redirect page

To enhance the payer experience for Buckaroo, we have reduced the loading time of the VisualForce page used to redirect to the Buckaroo payment form. The white redirect page should only be visible to the user for a brief moment, if at all.

Enrichment of Installment with default values on creation and update

When creating Installments through for instance the API, FinDock already used the default values for Payment Processor and Source if not provided in the Request. Now, FinDock uses the default values for Payment Processor, Source and Target when they are not included on creation or update.

- If the Source field is not provided, FinDock uses the default Source

- If the Payment Processor is not provided, but the Payment Method is provided, FinDock uses the default Payment Processor for that Payment Method

- If the Target is not provided and multi-merchant is enabled for the Payment Method & Processor, FinDock uses the default Target.

The default values can be set from the FinDock Setup.

Stripe: reworked setup and added language parameter

We have updated and reworked the Stripe for FinDock setup to reflect the latest Stripe version, removing some deprecated options.

In addition, we added “locale” as a new parameter to Stripe Payment API requests. This new parameter determines the language of the Stripe payment screens. The parameter locale can be used in the ParameterMap of the PaymentMethod object:

"PaymentMethod":{

"Name":"CreditCard",

"Processor" :"PaymentHub-Stripe",

"ParameterMap": {

"locale":"pl"

}

},

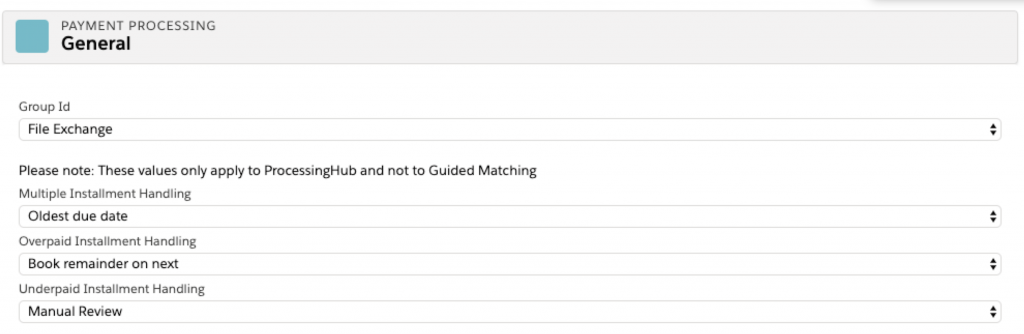

Added setting to determine handling of underpaid Installments

In FinDock there is a setting for how to handle overpaid Installments in the ProcessingHub. We have now added a setting for underpaid installments: Underpaid Installment Handling.

You can choose between ‘Partially Paid’

(default) and ‘Manual Review.’ The default behavior after this release is

similar to how underpaid installments have been handled thus far on the

ProcessingHub side. When the option ‘Manual Review’ is chosen, the

transactions are not matched automatically, but rather added to Manual Review.

NPSP Opportunity bank statement description mapping overridden on edit

Issue: The ‘Bank Statement Description’ field on Opportunity for NPSP was not properly mapped from Installments, and instead overridden with the default value [opportunity name] - bank statement description on edit when the status of the Installment was new.

Solution: This has been changed now so that custom mapping of the bank statement description field is maintained instead of overridden by the default value.