When you have payment data in more than one place, you need to regularly check that everything lines up correctly. This is an important step to ensure there are no mistakes, gaps, or unexplained discrepancies that need further investigation. It’s also your way to ensure your financial reports are accurate.

Typically the realm of accountants and financial offices, reconciliation is certainly the hard bit of payments. Particularly in small organizations where the checking is often completely manual, the reconciliation process is arduous and error prone.

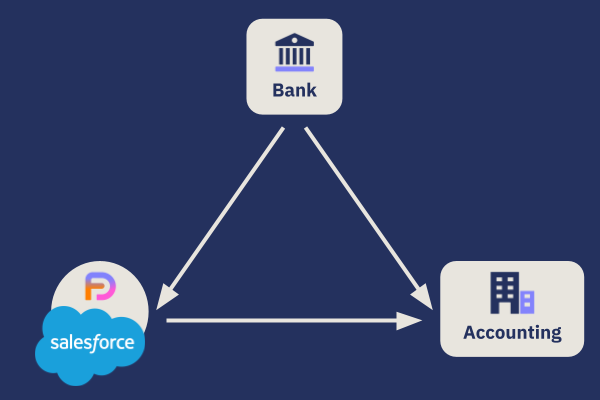

In its simplest form, you compare three data points: your bank account, your CRM and your accounting ledger.

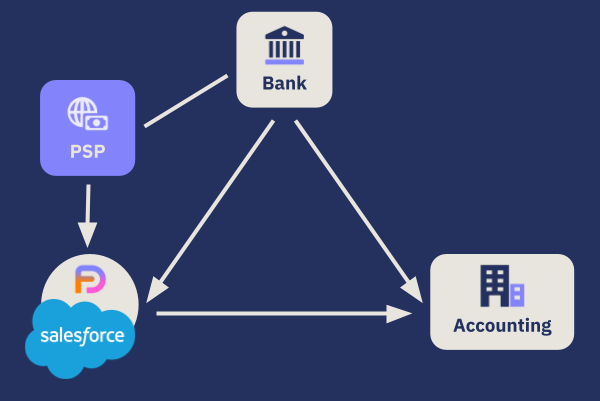

However, the complexity of the modern payment landscape changes the reconciliation picture. The reality of your payments on Salesforce likely include one merchant accounts at one or more PSPs. This is where FinDock really helps.

FinDock includes both automatic and custom matching capabilities to reconcile multiple sources of data. With accurate payment data in your Salesforce CRM, you can use any number of Salesforce features and apps to report, compare or automate workflows that support your business.

Out of the box, FinDock processes several standard bank file formats and automatically reconciles payment notifications from integrated PSPs.

With the right set of matching rules, you can process data faster, increase your matching rate and help guide reviewers of unmatched entries to the right data.

For all PSPs supported by FinDock, Guided Matching is already part of the integration. You also can set up reconciliation for any online payments. The Guided Matching rules provided by FinDock are extensive, but you can freely extend the matching logic by creating your own matching rules.