Processing and reconciling bank files

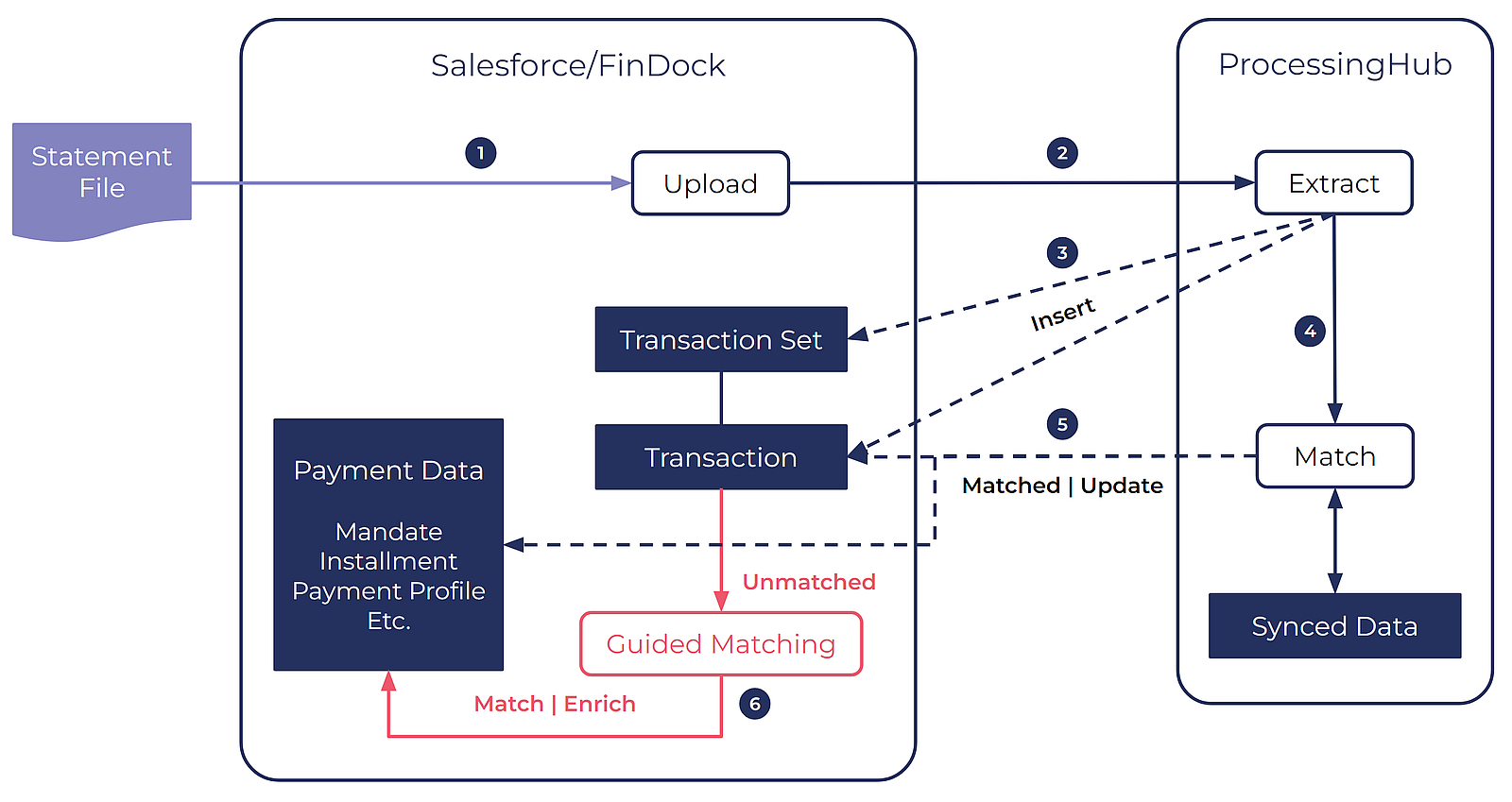

To support account reconciliation, FinDock can read and interpret standard bank files, transforming them into Inbound Report records or Transaction and Transaction Set records for matching.

Depending on the file type, incoming records are matched automatically on ProcessingHub or processed and matched through Guided Matching. This helps speed up reconciliation and eliminate the need for manual intervention.

Supported file types for reconciliation

The table below presents the file types supported by FinDock for reconciliation.

| File | Name | Processor - Method | Salesforce Record | Auto-Matched By |

|---|---|---|---|---|

| ADDACS | Automated Direct Debit Amendment and Cancellation Service | FinDock - Bacs Direct Debit | Inbound Report | Guided Matching |

| ARUDD | Automated Return of Unpaid Direct Debits | FinDock - Bacs Direct Debit | Inbound Report | Guided Matching |

| AUDDIS | Automated Direct Debit Service | FinDock - Bacs Direct Debit | Inbound Report | Guided Matching |

| Autogiro Mandate Advice | Mandate Advice | FinDock - Autogiro direct debit | Inbound Report | Guided Matching |

| Autogiro Payment Specification | Payment Specification | FinDock - Autogiro direct debit | Inbound Report | Guided Matching |

| BGMax | FinDock - Bankgiro Receivables | Transaction Set and Transaction | Guided Matching | |

| Bollettino Report | Bollettino Report | FinDock - SEDA | Inbound Report | Guided Matching |

| C72 | Cuaderno 72 | FinDock - SEPA (Spain) | Inbound Report | ProcessingHub |

| Camt.053 | Bank to Customer Statement | FinDock - CH-DD, LSV+, SEPA | Transaction Set and Transaction | ProcessingHub |

| Camt.054* | Bank to Customer Debit Credit Notification | FinDock - CH-DD, LSV+, SEPA | Transaction Set and Transaction | ProcessingHub |

| CODA | Coded Statement of Account | FinDock - SEPA (Belgium) | Transaction Set and Transaction | Guided Matching |

| DDIC | Direct Debit Indemnity Claim | FinDock - Bacs Direct Debit | Inbound Report | Guided Matching |

| Input Report | Input Report | FinDock - Bacs Direct Debit | Inbound Report | Guided Matching |

| MT 940 | Message Type 940 | FinDock - N/A | Transaction Set and Transaction | ProcessingHub |

| N43 | Norma 43 | FinDock - SEPA (Spain) | Transaction Set and Transaction | ProcessingHub |

| OCR | OCR Giro | FinDock - AvtaleGiro, Giro, etc. (Norway) | Inbound Report and Transaction Set | Guided Matching |

| Pain.002 | Customer Payment Status Report | FinDock - SEPA, SEPA CBI | Inbound Report | ProcessingHub |

| PlusGirot | FinDock - Bankgiro Receivables | Transaction Set and Transaction | Guided Matching |

(*) Supported versions: camt.054.001.02, camt.054.001.04

BIC support for MT 940

Extracting information from MT 940 files requires specific parsing rules for specific banks. The rules are applied based on the bank's BIC. For further information, please refer to our MT 940 article.

Upload a bank file for processing

The first step in the reconciliation process is to upload the bank file to Salesforce. This triggers the automated processing in FinDock.

Uploading is done through Chatter, so your ProcessingHub configuration must include a file exchange setup. The file name must not contain empty whitespaces.

Attach only one file per post. Attaching multiple files to a single post may cause errors.

To upload a bank file:

- Open the Chatter Group for file exchanges.

- Share a new post and attach the file. Adding text to the post is allowed, but not required.

- Click Share to post the file.

The status of the uploaded file can be tracked by taking a look at the auto-generated comments on the post from ProcessingHub or by using ProcessingHub Manager.

Camt.053 and camt.054 with images

In the Swiss market, camt.053 and camt.054 files from PostFinance, the financial services unit of Swiss Post, may include images of ESR (Einzahlungsschein mit Referenznummer) payment slips. The files and images come from the bank in a zip file. When FinDock processes files with images, the images are attached to the corresponding records in Salesforce.

The original images are in TIFF format, so you cannot preview them in Salesforce. However, on the target level, you can change the file format to PNG to preview the file in Salesforce. A very common use case for previewing during the Guided Review process.

To change the CAMT image file format for previewing:

- Launch the FinDock app and click Setup.

- Click on the ProcessingHub tile to open the ProcessingHub settings.

- Click the Target tab.

- In the list of targets, click the arrow icon to the right of your SEPA target and select Settings.

- For Payslip option field, enter

png(orboth) and click Save.

Automatic matching on ProcessingHub

ProcessingHub fetches an uploaded file and starts processing it automatically. For file types (excluding CODA and OCR) transformed into Transaction Set and Transaction records, FinDock automatically matches entries based on the End-to-End Id or payment reference (Final Payment Reference on Installment).

When FinDock finds an installment, FinDock handles the incoming record based on ProcessingHub settings explained in the following sections. Once the processing is completed, the results are pushed to Salesforce. Unmatched records can be further processed via Guided Matching.

Other file types, such as CODA, OCR and those transformed to Inbound Report records, are put to Guided Matching for automatic matching.

Default automatic matching on ProcessingHub

For inbound payment data matched on ProcessingHub, additional criteria determine what action FinDock takes, as outlined in the table below.

| Entry* | Installment Record Type | Additional Criteria when References are Matched | Record Status after Processing | Installment Status after Processing | Installment Amount Open after Processing | Payments after Processing |

|---|---|---|---|---|---|---|

| Credit | Receivable | Record Amount = Installment Amount Open | Matched | Collected | 0 | New payment with Record Amount |

| Credit | Receivable | Record Amount < Installment Amount Open | Matched | Partially Paid | Installment Amount Open - Record Amount | New payment with Record Amount |

| Credit | Receivable | Record Amount > Installment Amount Open | Matched | Collected | Installment Amount Open - Record Amount | New payment with Record Amount |

| Debit | Receivable | Record Amount = Installment Amount & Installment Status = Collected or Rejected | Matched | Reversed | Installment Amount | New payment with -1 * Record Amount |

| Debit | Receivable | Other | No Match | N/A | N/A | N/A |

| Credit | Payable | Record Amount = Installment Amount | Matched | Reversed | Installment Amount Open + Record Amount | New payment with Record Amount |

| Debit | Payable | Record Amount = Installment Amount Open | Matched | Paid | 0 | New payment with -1 * Record Amount |

| Debit | Payable | Record Amount < Installment Amount Open | No Match | N/A | N/A | N/A |

(*) Entry refers to the bank account transaction - credit is money coming into the account, and debit is money leaving the account.

Transaction amount > Installment amount

If the transaction amount is greater than the installment amount, FinDock takes into account the Overpaid Installment Handling setting. This setting has three options:

- Manual Review: the transaction is marked for manual review and not processed any further

- Book all on current: FinDock books the total amount against the current installment, creating one payment for the amount of the installment and a second payment for the remainder

- Book remainder on next: FinDock creates a payment for the amount of the installment, marks it as collected, and moves to the next installment based on the Multiple Installment Handling setting, creates a payment for the amount of the next installment, marks it collected, and so forth. This continues until the transaction amount is fully booked or there are no more Installments. If there are no more installments and the transaction amount is not yet fully booked, the entire operation is rolled back, and the transaction is marked for guided review.

Transaction amount < Installment amount

If the transaction amount is less than the installment amount, FinDock takes into account the Underpaid Installment Handling setting. This setting has two options:

- Partially Paid (default): If the transaction has a smaller amount than the installment, FinDock creates a payment for the amount of the transaction and it marks the installment as ‘Partially paid’ rather than Collected.’

- Manual Review: When the option ‘Manual Review’ is chosen, the transactions are not matched automatically, but rather added to Manual Review.

Multiple installments

If the Payment Reference or End to End Id on the transaction matches multiple installments, the automatic matching flow depends on the Multiple Installment Handling setting. This setting has three options:

- Manual Review: any transaction that matches multiple installments is marked for manual review

- Oldest Due Date: FinDock selects the oldest (based on due date) open installment and uses that to match the transaction using the Basic Flow for Debit Transactions (see below).

- Most recent Due Date: FinDock selects the installment with the most recent due date (which might be in the future) and uses that to match the transaction using the Basic Flow for Debit Transactions.

Batch transaction

If FinDock is unable to locate an installment for the transaction, but it can find a FinDock file record where the group identifier field matches the Payment Reference or End to End Id, FinDock treats the transaction as a batch payment.

If the total amount of the installments connected to the file record matches the amount of the transaction, all the installment are marked as collected and Payment records are created. If the total amount differs or if no installment or file record is found, FinDock marks the transaction for manual review. For more information, see batch reconciliation.

Transaction sub-elements with charges

If a transaction contains transaction sub-elements, these are matched if the parent transaction is matched.

Matching for transaction sub-elements means:

- A new installment with RecordType ‘Payable’ is created with status ‘Paid’

- A new payment with a negative amount for the charge is created under the installment.

When transaction sub-element record is set to Matched, the installment and the transaction sub-element are related via a lookup on the installment, allowing you to create comprehensive reports to detail the charged amount per bank. The transaction sub-element contains the originating party. Usually this is provided in the form of a BIC for the charging bank.