How Gift Aid works

Gift Aid is a tax relief scheme that allows charities operating in the UK to claim the tax a donor has paid. For more information on how Gift Aid works, along with the rules and regulations governing Gift Aid, please visit the HM Revenue & Customs (HMRC) and read the UK government guidance.

With the Gift Aid extension, you can use FinDock to manage Gift Aid Declarations (GADs) and claim Gift Aid through a direct integration with HMRC.

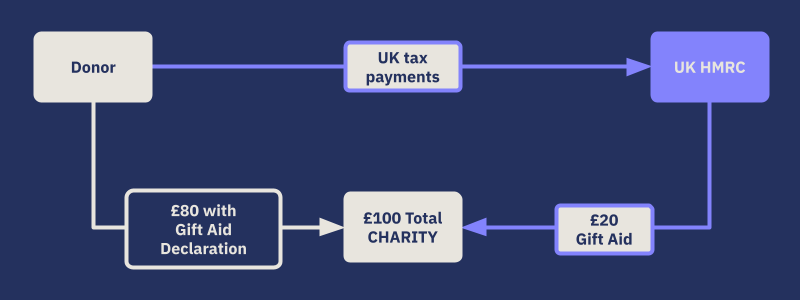

Gift Aid allows donors in the UK to instruct the HMRC to also give a share of their tax to the charities that received the donations. The calculation goes like this:

- The donor gives £80 to a charity that is recognized by the HMRC.

- The donor includes a Gift Aid declaration allowing the charity to claim Gift Aid.

- The charity gets 25p for every £1 donated. In this case, the Gift Aid is £20.

FinDock determines the applicable tax rate through a managed Salesforce custom metadata type called Gift Aid Tax Rates. The rate is checked as part of each Gift Aid claim process.

This is the primary tax relief scheme that FinDock currently supports. The HMRC has other Gift Aid frameworks such as the Gift Aid small donations scheme (GASDS). This particular scheme is not supported out-of-the-box by FinDock, though we do support donations from partners (see section 3.10.3 of the UK government guidance) through Gift Aid Distribution.