The Gift Aid package adds two objects to your Salesforce org:

- Gift Aid Declaration

- Gift Aid Distribution Scenario

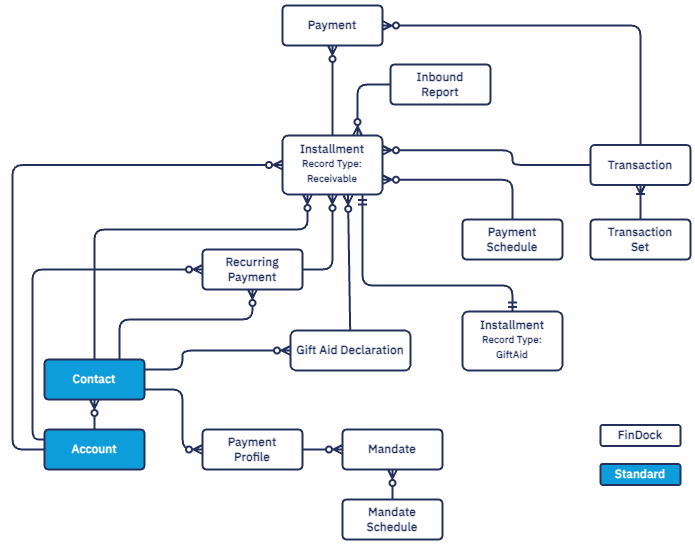

The distribution relationships are only to Account and Contact, whereas the declaration has relationships as illustrated below.

In addition to the declaration and distribution objections, the following fields are added to the Installment object.

| Field Label | Field Name | Data Type | Description | Used on Record Type |

|---|---|---|---|---|

| Related Transaction | gaid__Related_Transaction__c | Lookup (Installment) | This is the receivable installment that is the basis of the Gift Aid installment. | Gift Aid |

| Gift Aid Claimed | gaid__GiftAid_Claimed__c | Checkbox | Indicates if Gift Aid has been claimed for this installment. | Receivable |

| Gift Aid Declaration | gaid__Gift_Aid_Declaration__c | Lookup (Gift Aid Declaration) | When a new Gift Aid installment is created as part of the payment, this field contains a link to the Gift Aid declaration which at the time of generation was proof that this installment was eligible. | Gift Aid |

| Exclude from Gift Aid | gaid__Exclude_from_GiftAid__c | Checkbox | If true (checked), this receivable installment is not considered for Gift Aid. | Receivable |

| Eligible for Gift Aid | gaid__Eligible_for_GiftAid_formula__c | Formula (Checkbox) | According to a specific formula, FinDock determines if this receivable installment is eligible for Gift Aid. If the installment is eligible, the checkbox is marked (true). | Receivable |

| Contact has Active GAD | gaid__Contact_has_Active_GAD__c | Deprecated. | ||

| Valid Gift Aid Declaration | gaid__Valid_Gift_Aid_Declaration__c | Lookup (Gift Aid Declaration) | The valid declaration at the receivable installment due date. If there is no currently valid declaration, but there is one in a cooling off period, that is selected. Otherwise, the field is empty. | Receivable |

| Consider for Gift Aid | gaid__Consider_for_Gift_Aid__c | Text(1) (External ID) | This field is for internal performance optimization only. | Receivable |

| Gift Aidable Amount | gaid__Gift_Aidable_Amount__c | Currency (16, 2) | If only part of a donation is eligible for Gift Aid, enter the eligible amount in this field on the receivable installment. | Receivable |

| GA Claim Total | gaid__GA_Claim_Total__c | Currency (16, 2) | This field is calculated by FinDock. It shows the amount of the receivable installment (original donation) or the amount of the Gift Aidable field if that is used. In Gift Aid Distribution scenarios, the selected amount is multiplied by the distribution percentage. | Gift Aid |

The Contact object gets one new field.

| Field Label | Field Name | Data Type | Description |

|---|---|---|---|

| Has Valid GAD Now | gaid__Has_Valid_GAD_Now__c | Checkbox | This field is for marketing purposes only. The values can be set by running the batch Apex class ContactsUpdateHasValidNowGadJob or scheduling Apex class ContactsUpdateHasValidNowGadSchedule. The checkbox is marked if the contact had a valid declaration on the date when the Apex class was run. |

API name: gaid__Gift_Aid_Declaration__c

The Gift Aid Declaration object is used to register and track Gift Aid declarations made by your donors. All other functionality of the Gift Aid implementation for FinDock depends on the details in the Gift Aid declaration record.

Gift Aid Declaration fields

| Field | Description |

|---|---|

| Type | Deprecated |

| Close Reason | Reason for closing the declaration. Only the value “Termination of Employment” is pre-shipped. Other values can be added through customization according to your own charity’s needs. |

| Reason for Deactivation | Optional free text field for a more detailed explanation for closing the declaration. This field can be used as input, for example, for later follow up as part of an internal donor management review process. |

| Active | When checked, the declaration can be used to claim Gift Aid. This checkbox typically does not need to be changed manually. It is primarily for process and workflow actions. |

| Start Date | This field can be left empty to have the maximum allowed validity period (current fiscal year minus four years), or you can set a start date that limits validity of this declaration for past donations, making them ineligible for Gift Aid. |

| End Date | Date when the declaration ceases to be valid. This field can be left empty if no end date is specified by the donor. |

| Date Made | Date the declaration was made by the donor (or when you received it). |

| Confirmation Date | The date on which the Gift Aid declaration has been confirmed to the customer. This is the start of the cooling-off period for oral declarations. By default the value of this field is set to Date Made when you save the declaration. |

| Contact | Donor who has made the Gift Aid declaration. This is prefilled using the contact where you are creating the new declaration. |

| Custom First Name | If a different name should be used than the name on the contact, you can enter it here. This overrides the contact name and remains as such (i.e. no further sync between contact and declaration names). |

| Custom Last Name | Handled the same as Custom First Name. See above. |

| Postal code | Enter the postal code for UK residents, for non UK Residents, enter "X". NOTE: This field must be manually filled in or handled through custom business logic. Because the contact address can be stored in different ways in Salesforce, FinDock cannot automatically determine the correct address value. |

| House Name or Number | Enter the house or building number or name for UK residents, for non-UK residents, enter the Street, Number and City. NOTE: This field must be manually filled in or handled through custom business logic. Because the contact address can be stored in different ways in Salesforce, FinDock cannot automatically determine the correct address value. |

| Overseas | If the address is a non-UK address, this checkbox must be marked. This parameter is required by HMRC. |

| Acquisition Method | Define here how the declaration was received by your organization. The options are Written (paper), Oral or Digital. NOTE: There is no difference between Written and Digital acquisition for HMRC. We recommend using one or the other for non-oral declarations unless you have specific requirements for tracking the paper vs. digital acquisition. |

| Cooling Off Period End Date | If the acquisition method is oral, this field indicates when the mandatory cooling off period ends. The date is automatically calculated based on the “Number of days cooling-off period” setting of the Gift Aid extension (under FinDock Setup) when you save the declaration. You can modify it later if needed. |

| Valid Now | Formula field that calculates of the declaration is valid today. |

| In Cooling Off Period | Formula field that indicates if the declaration is cooling off today. |

The Gift Aid Distribution Scenario is used to distribute Gift Aid claims on donations from partners to the individual contacts.

Gift Aid Distribution fields

| Field | Description |

|---|---|

| Account | The organization (partnership) the distribution scenario applies to in a master-detail relationship. |

| Select Installment | Select an instalment from the picklist for distribution. |

| Total Amount | Total amount of the selected installment |

| Partner | The individual contact from the Account that can represent the Gift Aid claim. The contact record must have an active Gift Aid declaration. |

| Percentage | The percentage of the donation to be allocated to the given contact for Gift Aid. |

| Amount | The calculated amount that is used for claiming Gift Aid through the given contact. |