This rule is always included in the rule execution plan as the last step of Guided Matching using a three-step process as outlined here.

First the Process Installment rule calculates the required installment changes to fully match the Transaction or Inbound Report record. These changes are not applied to any record at this point.

The Installment Change Calculator takes as input:

- A Transaction or Inbound Report record

- A list of one or more identified installments (order is important for the calculation algorithm)

As output, the calculator determines the required installment changes to fully match the input record. An installment change can be:

- New status for the installment

- Amount for the first Payment record that needs to be calculated

- If there is an overpayment, the amount for the second Payment record is calculated. (This is only for overpaid installment scenarios in which the overpaid part, the remaining amount, is inserted into the system as a separate Payment record.)

- New Last Collection Date for the installment

- New Last Reversal Date for the installment

The process continues until all the full transaction amount has been accounted for.

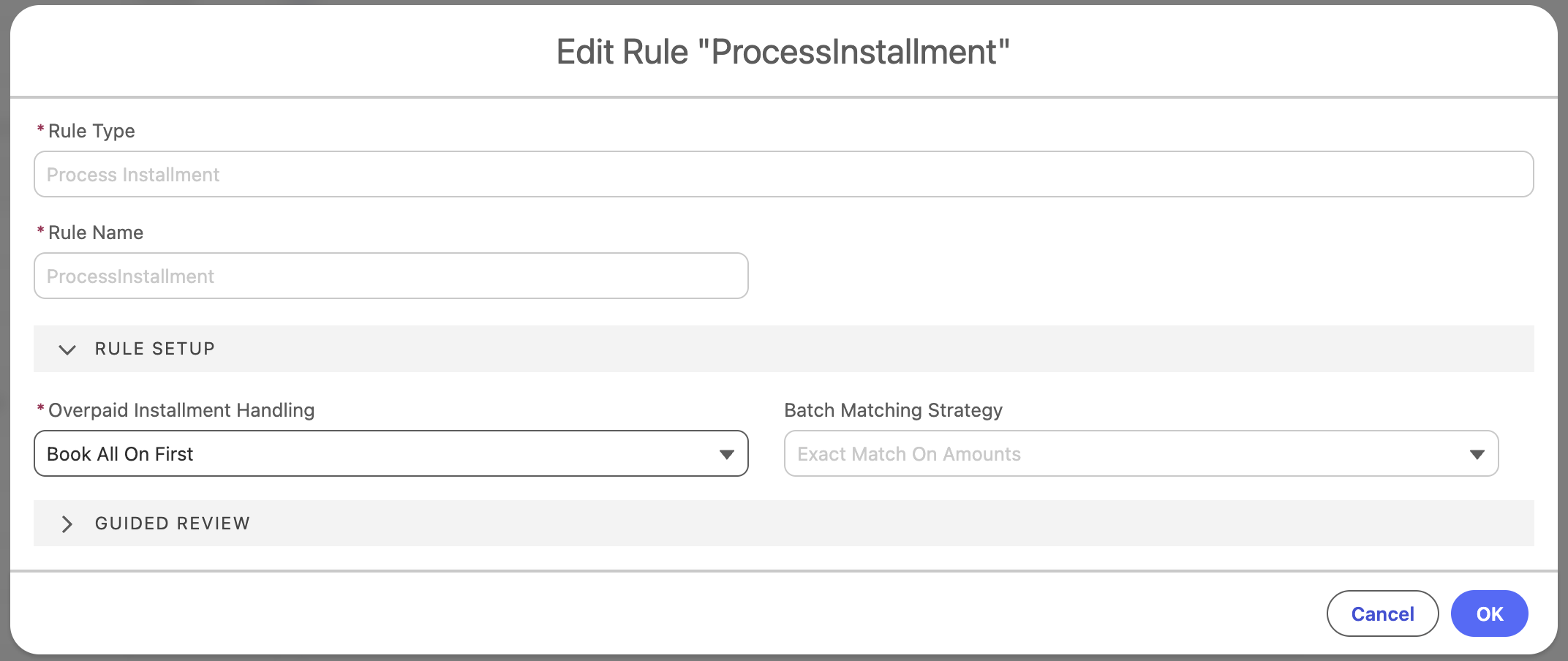

The Installment Change Calculator has three overpaid installment handling options you can select from the Overpaid Installment Handling picklist.

- Book Remainder On Next: In the case of overpayment, the full overpayment amount is always allocated when the rule is processed. A payment is created for the full open amount on the first installment. The remaining amount is booked on further identified installment(s). If there are no further identified installments, the transaction or inbound report always goes to Guided Review.

- Book All On First: The full amount is booked against the first installment with two Payment records: (1) with the open amount, and (2) the remaining amount.

- Leave Remainder on Transaction / Inbound Report: In the case of overpayment, the overpaid amount is added to the Open Amount on the Transaction or Inbound Report. This open amount can be used to partially or fully pay further installments each time Guided Matching is executed on the record. For further information, see the examples below.

The rule setup includes a Batch Matching Strategy which currently cannot be changed. There is one strategy for batch matching, and that is the batch amount must exactly match the sum total of all amounts of the linked installments.

If you have and Transaction or Inbound Report record for 250 and two installments for 100, this is how the over payments can be handled.

EXAMPLE - Book All on First

Installment 1: Collected (overpaid)

| Payment 1: 100

| Payment 2: 150

Installment 2: Pending (or similar status)

EXAMPLE - Book Remainder on Next

Installment 1: Collected

| Payment 1: 100

Installment 2: Collected (overpaid)

| Payment 1: 100

| Payment 2: 50

EXAMPLE - Book Remainder on Transaction / Inbound Report (first execution)

Installment 1: Collected

| Payment 1: 100

Installment 2: Collected

| Payment 1: 100

Record: Partially Matched, Open Amount: 50

Process Installments (second execution, 3rd installment for 100 identified)

Installment 3: Partially paid

| Payment 1: 50

Record: Matched, Open Amount: 0

If you use the Book Remainder on Transaction / Inbound Report option, you can still end with Guided Review based on the Guided Review Assessment. However, the already processed installments are not editable, unlike with the Book Remainder on Next option.

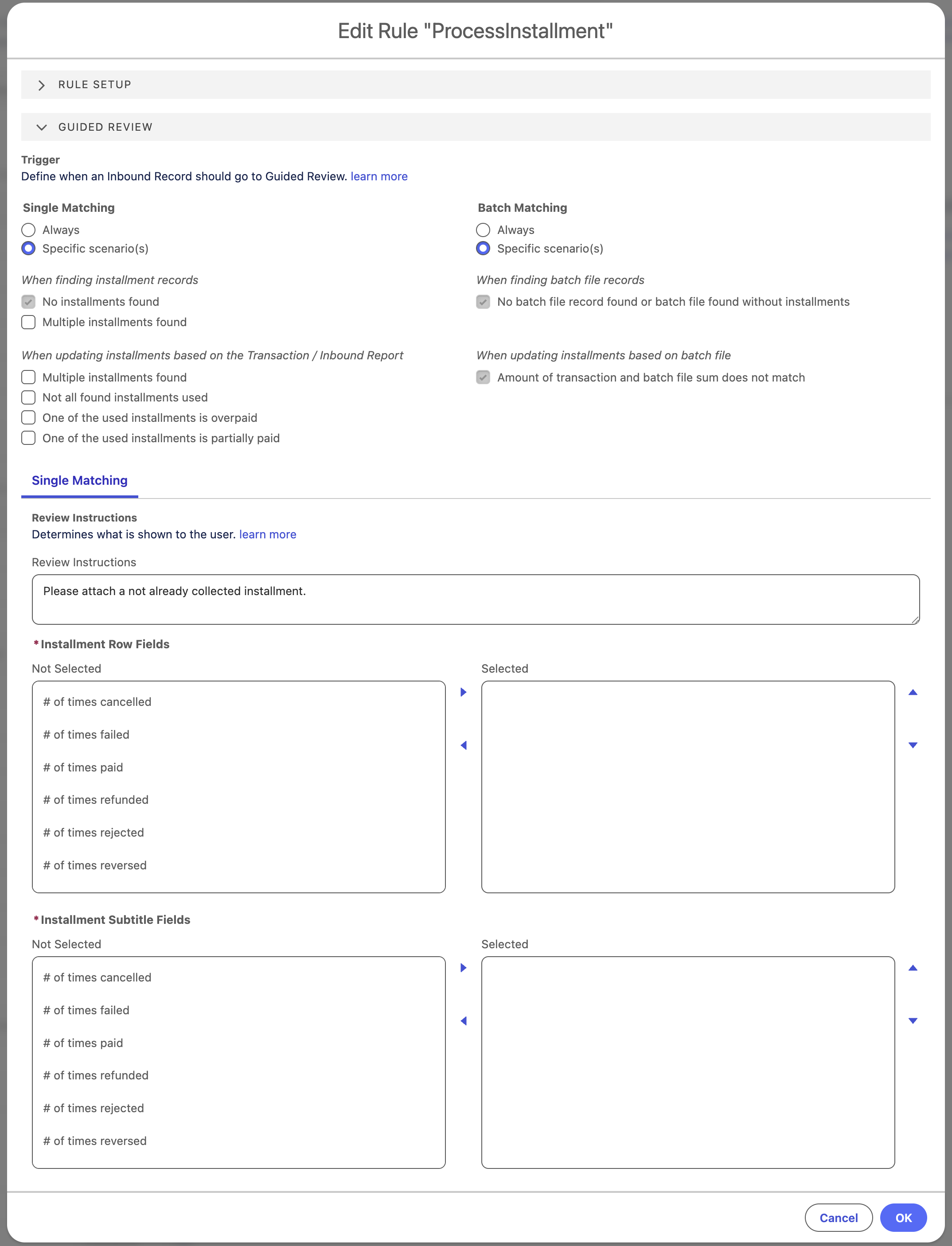

Based on the calculated changes, FinDock determines if processing can be done automatically or if manual validation is needed, in which case the record is put into Guided Review. There are six criteria for making this assessment for single installment matching. For batch matching, you can either set batch records to always go to Guided Review, or to only go when the batch cannot be matched.

- Always: The record is always put into Guided Review, regardless of matching status.

- Multiple installment identified: If a previous query rule identified more than one installment, the record is put into Guided Review.

- Multiple installments matched: If the calculated installment changes include more than one installment, the record is put into Guided Review.

- Not all identified installments matched: If more installments were identified by an earlier query rule than have been matched, that is, not all identified installments have been used, the record is put into Guided Review.

- One of the matched installments is overpaid: If more money was received than expected so that one installment is overpaid, the record is put into Guided Review.

- One of the matched installments is underpaid: If less money was received than expected so that one of the installments is only partially paid, the record is put into Guided Review.

If FinDock determines that the Transaction or Inbound Report record does not need to go into Guided Review, the calculated changes from step 1 are processed, meaning that all affected installments are updated, and payments are created accordingly.

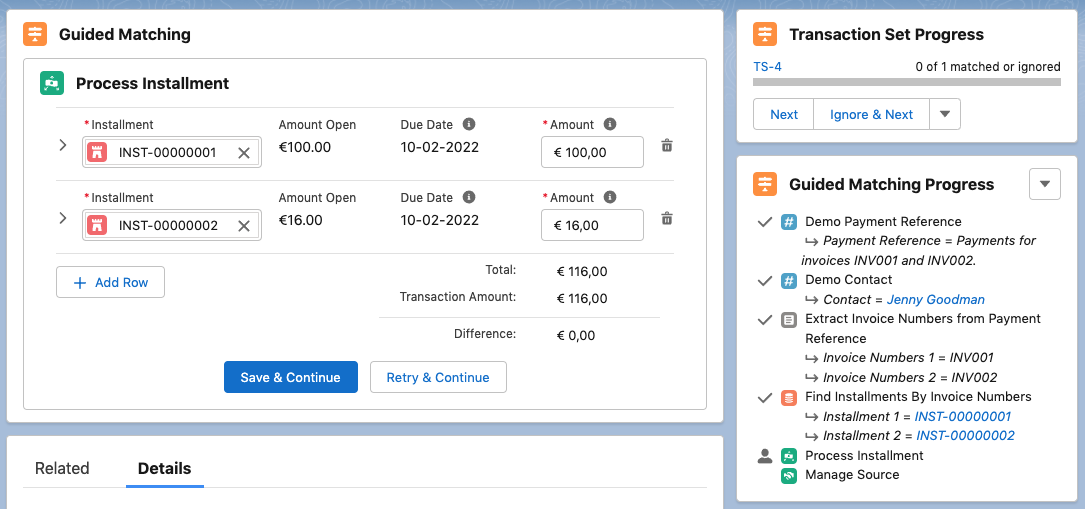

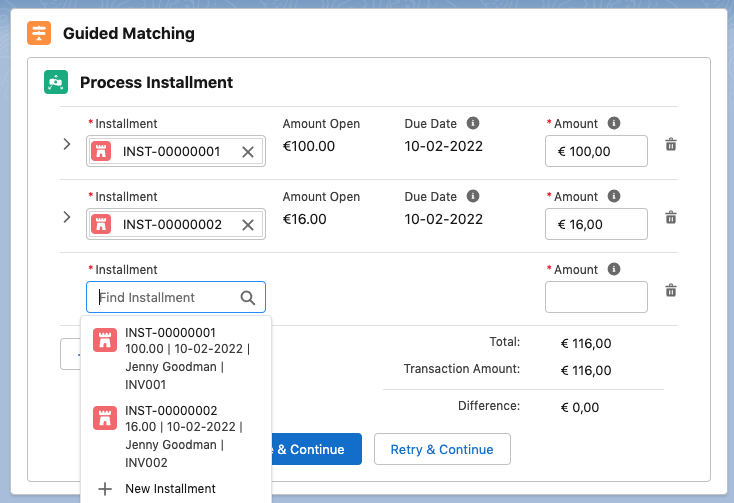

Transaction or Inbound Report records that go into Guided Review are presented as shown here:

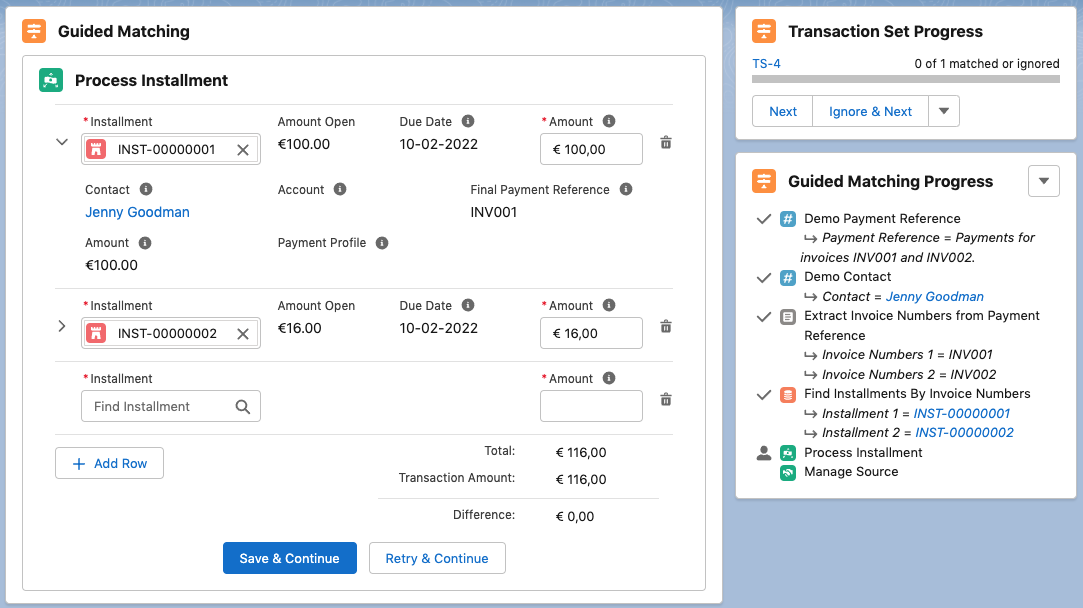

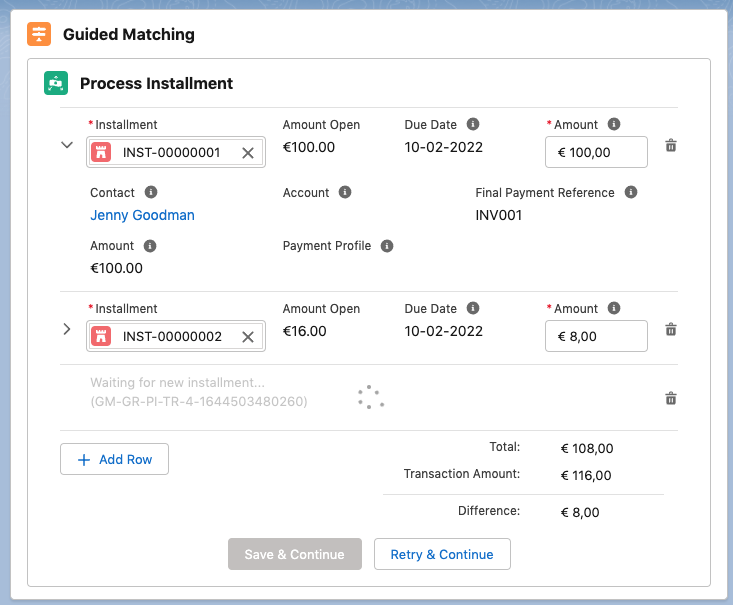

If the incoming record is a debit (e.g. a refund) instead of a credit, the review component shows the Installment Amount instead of Amount Open. By clicking on an Installment record, you can expand the view to see details prefilled with calculated changes, as shown here:

The first selected field in the configuration is displayed as the third field in the third row (empty in the above screenshot). Next selected fields are shown in further rows below.

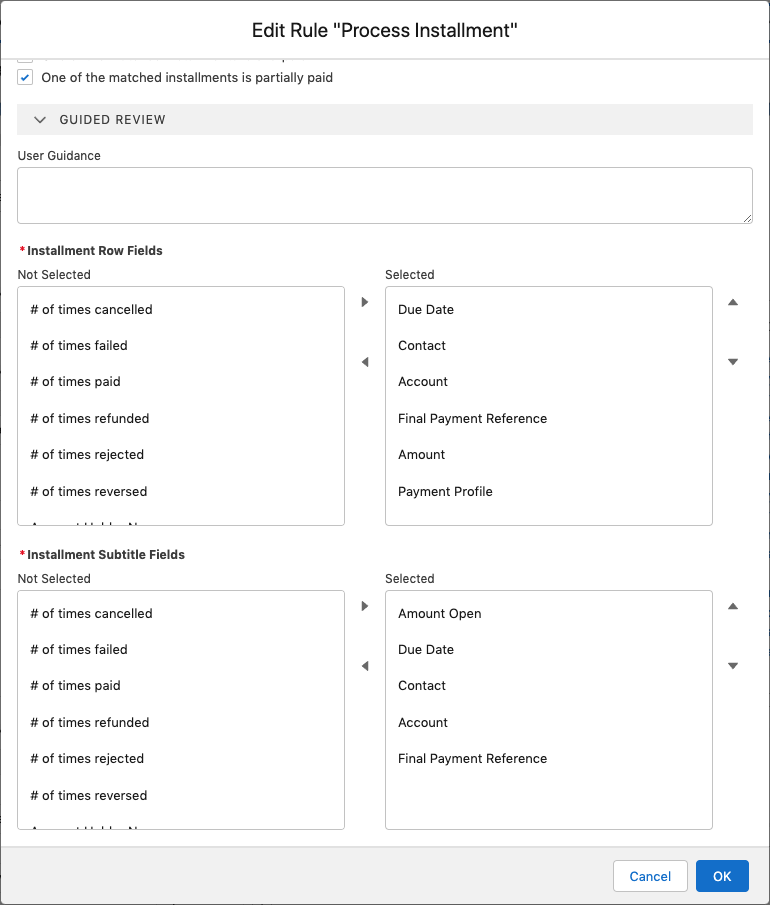

The fields that are displayed in an installment row are configurable (see Installment Row Fields configuration screenshot below).

The Installment lookup shows as default results all installments that:

- Have the same Contact or Account as the matched record

- Are not closed (status is not Collected, Reversed, Refunded, Rejected, Canceled or Failed).

The search box searches in all Installments fields and shows results as:

- Title: Installment Name

- Subtitle: Configurable (see Installment Subtitle Fields configuration screenshot above)

If + New Installment is used, a new tab opens to create a new installment. The New Installment form (pictured below) is prefilled with:

- Contact, taken from the Transaction / Inbound Report record

- Account, taken from the Transaction / Inbound Report record

- Amount, remaining amount

- Amount Open, remaining amount

- Source: Default source

- Status: New

- Due Date: Date on the Transaction / Inbound Report record

- Bank Statement Description: Payment Reference on the Transaction / Inbound Report record

- Payment Method, Payment Processor, Target

- If Transaction: Transaction Set > Default Payment, etc.

- If Inbound Report: Directly from the Inbound Report

- Payment Profile, taken from the Transaction / Inbound Report record

- External ID: Prefilled with generated unique string

The New Installment form regularly polls if an installment has been created with the expected external Id. For this to work, the External Id field must be on the Installment page layout.

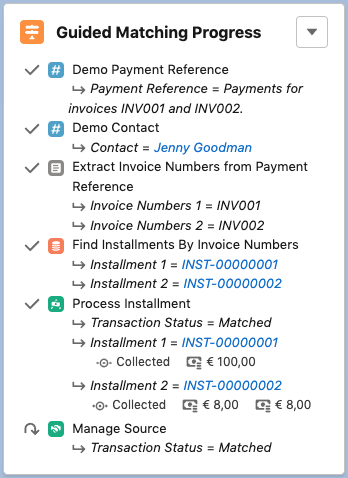

Save & Continue is disabled until the full Transaction Amount has been accounted for. After clicking Save & Continue, the form is processed, which is seen in the progress component which shows the payment amounts for the installments.

The table below outlines how FinDock decides what to do with the matched installment. The same logic applies to single and multi-installment matching. For multi-installment matching, the logic is applied to each identified installment sequentially until the inbound record amount is fully allocated. The calculation variables and results are recorded in the Guided Matching Log field of the Inbound Report or Transaction record.

| Entry Type | Installment Record Type | Additional Criteria | Record Status after Processing | Installment Status after Processing | Installment Amount Open after Processing | Payments after Processing |

|---|---|---|---|---|---|---|

| Credit | Receivable | Record Amount = Installment Amount Open | Matched | Collected | 0 | New payment with Record Amount |

| Credit | Receivable | Record Amount < Installment Amount Open | Matched | Partially Paid | Installment Amount Open – Record Amount | New payment with Record Amount |

| Credit | Receivable | Record Amount > Installment Amount Open | Matched | Collected | Installment Amount Open – Record Amount | New payment with Record Amount |

| Debit | Receivable | Record Amount = Installment Amount & Installment Status = Collected & Installment Amount Open = 0 | Matched | Reversed | Installment Amount | New payment with -1 * Record Amount |

| Debit | Receivable | Record Amount = Installment Amount - Installment Amount Open & Installment Status = Partially Paid | Matched | Reversed | Installment Amount | New payment with -1 * Record Amount |

| Debit | Receivable | Other | Failed | N/A | N/A | N/A |

| Debit | Payable | Record Amount = Installment Amount Open | Matched | Paid | 0 | New payment with -1 * Record Amount |

| Debit | Payable | Record Amount < Installment Amount Open | Failed | N/A | N/A | N/A |

| Credit | Payable | Record Amount = Installment Amount & Installment Status = Rejected | Matched | Reversed | 0 | No payment |

| Credit | Payable | Record Amount = Installment Amount & Installment Status = Paid & Installment Amount Open = 0 | Matched | Reversed | 0 | New payment with Record Amount |

| Credit | Payable | Installment Amount Open after calculation <= 0 | Matched | Paid | Installment Amount Open + Record Amount | New payment with Record Amount |

| Credit | Payable | 0 < Installment Amount Open after calculation < Installment Amount | Matched | Partially Paid | Installment Amount Open + Record Amount | New payment with Record Amount |

| Credit | Payable | Installment Amount Open after calculation >= Installment Amount | Matched | Outstanding | Installment Amount Open + Record Amount | New payment with Record Amount |

If Guided Matching matches a partially paid installment and the inbound record debit amount equals the already paid amount, the installment is set to Reversed. A negative Payment record is created for the debit amount, and the Amount Open on the installment is reset to Amount. If the debit amount does not equal the already paid amount, the inbound record is set to Guided Review.

When installment:

- Amount = 100

- Amount Open = 50

- Status = Partially paid

If debit amount = 50, then:

- Inbound record Status = Matched

- Installment Amount = 100

- Installment Amount Open = 100

- Installment Status = Reversed