The Saferpay integration supports several payment methods through Saferpay by Worldline (formally SIX Saferpay), including methods like TWINT particularly for the Swiss market.

| Payment Method | Online Payment Flow | Integration Patterns | Data Entry | One-time | Recurring | Refunds |

|---|---|---|---|---|---|---|

| Apple Pay | Online Redirect | API | No | |||

| Card | Online Redirect | API | No | |||

| Google Pay | Online Redirect | API | No | |||

| PostFinance Card (DEPRECATED) | Online Redirect | API | No | |||

| PostFinance e-finance (DEPRECATED) | Online Redirect | API | No | |||

| PostFinance Pay | Online Redirect | API | No | |||

| TWINT | Online Redirect | API | No |

To use certain payment methods like TWINT, you may need to contact Saferpay support. TWINT recurring payments, for instance, require a business contract with Secure Alias Storage and TwintMerchantInitiatedPayment (User On File) enabled on your terminal.

Prerequisites

- FinDock is installed and configured.

- ProcessingHub is connected.

- WebHub is connected.

Follow the standard procedure for installing payment processors to add the Saferpay payment extension and activate payment methods.

Check and assign the required permissions. If you are using custom permission set groups, ensure the package-specific permission sets are assigned.

Configuring the Saferpay extension requires setting up a test account with the Saferpay Backoffice and a production account with Saferpay myPortal. Some information from your Saferpay settings needs to be copied to the Saferpay for FinDock extension settings, so you will need to have both applications open to complete the configuration.

To configure Saferpay for FinDock:

- Launch the FinDock app and click the FinDock Setup tab.

- Click Processors & Methods in the left-hand menu.

- On the Installed tab, click the Saferpay processor entry.

- On the Accounts tab, click Add account.

- Fill in the initial settings.

- Name: Add a name for the Saferpay account (distinguishable from other targets).

- Notification URL: this is automatically filled by FinDock and shown on the target once you save the target. This is used by Saferpay to send event messages to FinDock.

- Default Account: enable if this account should be used as the default account for Saferpay payments.

- Is Test: enable if you are setting up a test target.

- In a separate tab, register or log in to the Saferpay Backoffice at

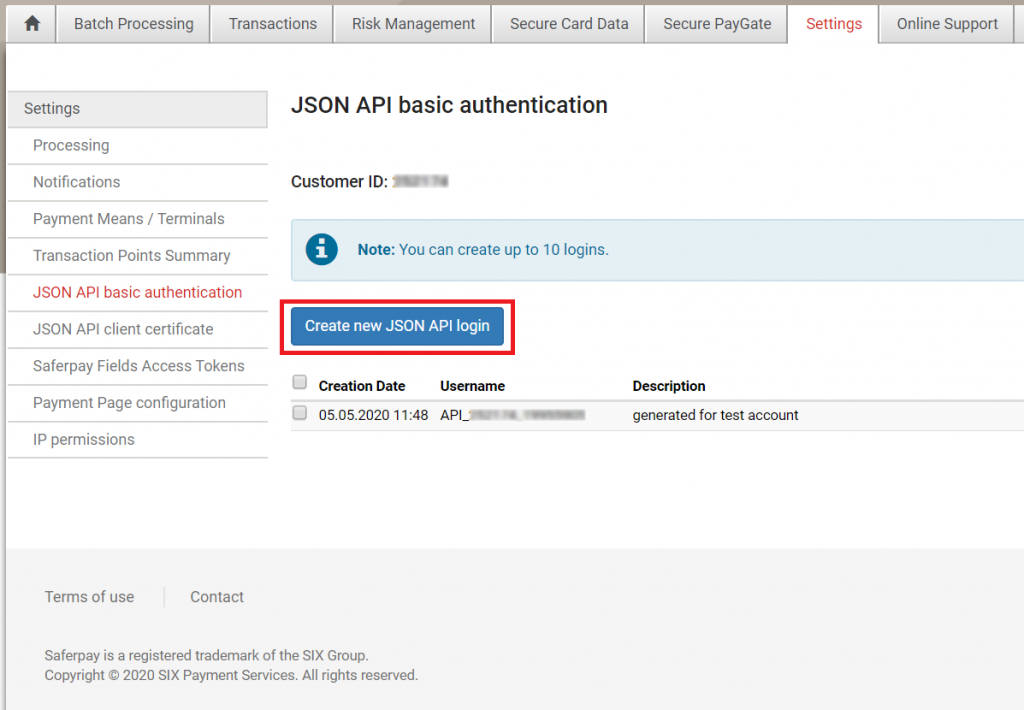

https://test.saferpay.com/BO/. If you are configuring a production org, use the Saferpay myPortal:https://myportal.six-payment-services.com/merchantportal/ - Click the Settings tab and then click JSON API basic authentication.

- When you created your back office account, you received an email from Saferpay with an JSON API username and password. If you no longer have this email, click Create new JSON API login to get a new login username and password.

- Copy-paste your JSON API login username and password into the corresponding fields in the Saferpay extension settings in FinDock.

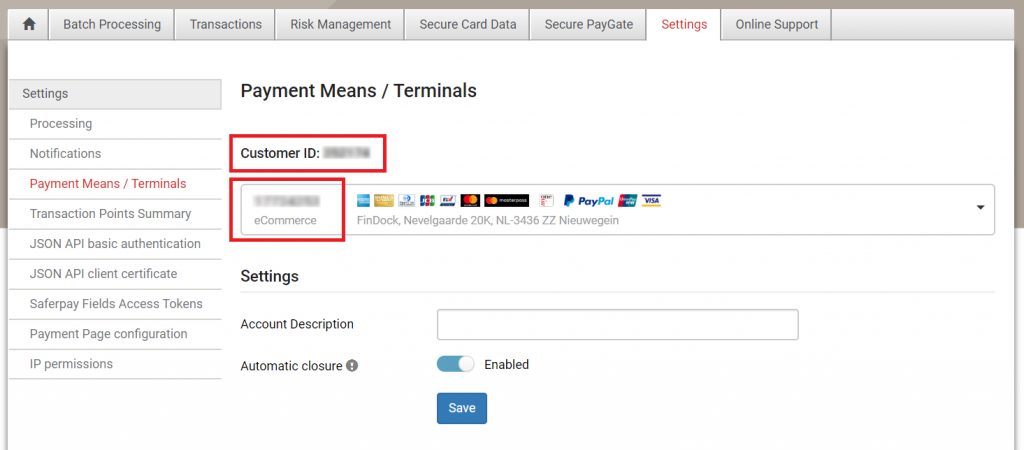

- In the Saferpay portal, go to the Terminals settings under Payment Means.

- Copy-paste your Customer ID and eCommerce Terminal ID into the corresponding fields in the Saferpay extension settings in FinDock.

- Adjust the FinDock extension settings as needed.

- Use Secure Alias Storage: if your Saferpay contract includes the Secure Card Data module, enable this setting to use credit card aliases. NOTE: This setting is required when using TWINT recurring payments.

- Log Requests: activate if you want to log all Saferpay connection events. This can be helpful with debugging during testing, for example.

- Click Save when you are done.

FinDock regularly listens for webhook notifications from Saferpay. This is normally sufficient for keeping payment data in Salesforce up to date.

However, it is possible that in certain rate scenarios payment collections are missed. To ensure all installments have the correct status, you can schedule a special Apex job, called sforfd.AssertUnprocessedTransactionsSchedule.

The Apex batch can be scheduled to run as needed, but we suggest running it hourly or daily if you are going to use it. The job queries all Saferpay installments with status Pending and makes callouts to get the latest status from Saferpay, updating the installments accordingly as needed.

With Saferpay payment methods that support recurring payments, you use payment schedules to collect future installments of the recurring payment as normal.

To enable recurring payment collection with TWINT, you need to have TwintMerchantInitiatedPayment (User On File) enabled on your terminal and a Saferpay Business contract with Secure Alias Storage. Please contact Saferpay support for assistance.

To collect TWINT recurring payments, FinDock creates a payment profile with the following details. No more details are provided by Saferpay & TWINT to FinDock:

- Brand = TWINT

- Wallet Type = TWINT

- Record Type = Credit Card

No payment profile is created for one-time payments with TWINT, since no relevant data is provided and no payment profile & mandate combination is needed for future collection.

Payment profile deduplication is based on a combination of the Contact Id and Wallet Type, (i.e. only one TWINT wallet for each contact).

To support Saferpay Secure Card Data capabilities, the Mandate object uses an Is Alias checkbox field. FinDock uses the checkbox to determine if the reference is an alias or a regular reference. By default, Is Alias is checked (true) for new recurring credit card payments.

The FinDock integration to Saferpay includes RegisterAlias in all initial recurring payment callouts. This stores the alias on the Saferpay side. In FinDock, the alias on stored on the mandate reference field.

When you run a payment schedule, FinDock handles the callouts as required for both regular and alias references based on the Is Alias field.

If you are migrating recurring credit card payments to Saferpay from another PSP, you must set Is Alias to true to be able to process further installments through Saferpay.

These digital wallet methods are treated as card payments by Saferpay. Please refer to their documentation for Apple Pay and Google Pay for details on how these payments are processed. These options need to be enabled in your Saferpay back office account, but no additional configuration is needed in the FinDock extensions (no separate payment methods to enable).

The payment profile associated with Apple Pay or Google Pay uses the credit card record type. The Wallet Type field indicates which digital wallet is used.

For recurring payments with Apply Pay or Google Pay, you collect future installments using payment schedules. These installments are automatically included in payment schedules with PaymentHub-Saferpay as the payment processor and CreditCard as the payment method.

You can use the following example messages to test if the Saferpay configuration is working as expected.

{

"SuccessURL": "https://www.example.com/success",

"FailureURL": "https://www.example.com/error",

"Payer": {

"Contact": {

"SalesforceFields": {

"FirstName": "Test",

"LastName": "Payment",

"Email": "testpayment@findock.com"

}

}

},

"OneTime": {

"Amount": "30"

},

"PaymentMethod": {

"Name": "Creditcard",

"Processor": "Six-Saferpay-for-FinDock"

},

"Settings": {

"SourceConnector": "PaymentHub"

}

}{

"SuccessURL": "https://www.example.com/success",

"FailureURL": "https://www.example.com/error",

"Payer": {

"Contact": {

"SalesforceFields": {

"FirstName": "Test",

"LastName": "Payment",

"Email": "testpayment@findock.com"

}

}

},

"Recurring": {

"Amount": "25",

"Frequency": "Monthly",

"StartDate": "2020-11-01"

},

"PaymentMethod": {

"Name": "PF Pay",

"Processor": "Six-Saferpay-for-FinDock"

},

"Settings": {

"SourceConnector": "PaymentHub"

}

}